The Prohibition on the Purchase of Residential Property by the Non-Canadians Act forbids non-Canadians from buying homes in metropolitan areas like Toronto and Vancouver. The measure was put into place by the Liberal government to control inflating housing prices in large cities.

In a statement, the federal housing minister Ahmed Hussein was quoted saying “Through this legislation, we're taking action to ensure that housing is owned by Canadians, for the benefit of everyone who lives in this country.”

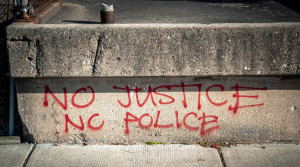

The act’s defenders hope that the ban will temper demand for housing, and drop prices to levels more affordable for everyday Canadians. The act's detractors though worry that the act will only increase the levels of racism and nativism against migrants while doing little to affect the cost of housing. So far most experts predict little will come from the foreign buyer's ban. Some have gone further, saying the government is knowingly scapegoating immigrants for high housing prices. A majority of Canadians already fear the economic costs of immigration and the feds' ban only validates their fears.

75% of Canadians believe the government's current immigration targets will put a strain on housing and social services, and an astonishing 49% of respondents think the government's 500,000 immigrants a year target is too bold. There is an inclination to paint these statistics as proof of growing xenophobia, but it would be reductive and wrong to consider 75% of Canadians as immigrant-hating racists.

Instead, most Canadians are following economic logic to its conclusions, however misguided. According to basic economic theory, an increase in people demanding houses should increase prices. Any increase in immigration theoretically should lead to an increase in housing prices, right? Let’s examine that.

Less than 6% of homeowners in Ontario and British Columbia are non-Canadian residents, yet prices have jumped by 20% in 2022. With such small levels of immigration against the massive gains in prices, it's hard to attribute it all to immigrants.

Vik Singh, an assistant professor in the global management studies program at the Ted Rogers School of Management at Toronto Metropolitan University agrees:

"Whatever patchy data we have, it shows that the percentage is actually pretty small when it comes to foreign buyers. I think the government had to do something [about housing], and it's easier to pick out the foreign buyer as a target.”

{https://twitter.com/rCanadaHousing/status/1609580835027517442}

At best immigration plays a minuscule role in the increase of housing prices, and many experts point to a lack of supply as the real issue.

According to the Canadian Mortgage and Housing Corporation, an additional 3.5 million homes are needed by 2030 to reach housing affordability. But building homes in Canada’s metropolitan areas is not easy. A new report from The U.K.'s capital on tap ranked Toronto the seventh most expensive city to build a house in the world. Vancouver was not far behind at ninth place. This also helps explain why both cities also top lists of the least affordable housing markets worldwide.

Increasing the availability of housing will mean contending with the costs of building, not curtailing demand by banning immigrants who have little effect on the market.

Building housing will also mean increasing the availability of space in big cities. A change in zoning will require political lobbying against entrenched NIMBYism and financial interests. NIMBYs or Not-In-My-BackYard is the acronym for local movements against increased density in largely white and affluent communities.

Many in the movement argue that increased density ruins communities and is a form of gentrification. Yet multiple studies point to increases in community cohesion and sustainability in more economically and racially diverse neighbourhoods. In reality NIMBYs, and financial actors gain tremendously from the unavailability of space. With less housing built, their properties increase in value, while those without properties are stuck with inflating prices.

Jenny Kwan, a member of Parliament who represents Vancouver East and the housing critic for Canada’s opposition New Democratic Party, points out how the law is missing the real culprits in the housing crisis.

“The government must target companies that invest in real estate for profit. We need to curb the financialization of housing.”

She is right. According to TransUnion Canada financial investors in the housing market have doubled from 2020 to 2021. Using shelter as a means for fast profit has had a harmful effect on housing from Whistler to Wyoming.

Already financial investors make up 28% of the US single-family housing market, and while groups like the Canadian Mortgage and Housing Corporation and the government of Canada do not collect information on financial investors in the housing market, figures by Statistics Canada do show multiple property owners own about a third of the Canadian housing market.

While many are mom-and-pop landlords with two or three properties, some are slumlords with dozens of rental units, and a growing number are large real estate firms. Firms like the Core Development Group found themselves in hot water from the public when they announced plans to spend $1 billion buying up single-family properties in Canadian cities. BlackRock, one of the world's largest investment firms set up a Toronto office with plans to expand its real estate portfolio to $14 billion. While very little is in single-family homes, no one is sure exactly how much is in townhomes, apartments, condos, and other housing stock that everyday Canadians choose to make a home. The Trudeau government has done little to collect more information on the scale of financial firms in the housing market and has instead given corporations and investors backdoors past the foreigner ban. As the act states:

“A corporation incorporated in Canada or a Canadian province that is controlled by a non-Canadian as defined in (a) and (b) and whose shares are not listed on a Canadian stock exchange or a stock exchange designated by the Minister of Finance under the Income Tax Act; “

Not only does the ban exempt foreign investors in Canadian-based companies, but it gives the Minister of Finance a say over whom the act affects, and does little for the Canadian financial corporations that are increasing demand for profit over homes.

Already financial groups are betting on a housing crash in Canada’s largest cities. Without adequately addressing the problem of finance the federal government's actions will do little if anything for prices. While there are immigrants who join the financialization of housing, adding to the unsustainability of housing, they are much more likely to be under-housed than searching for a quick buck in the housing market. If Canadians continue to be fed ‘pop economics’ by the federal government, they will only grow to further resent immigrants.

By

By