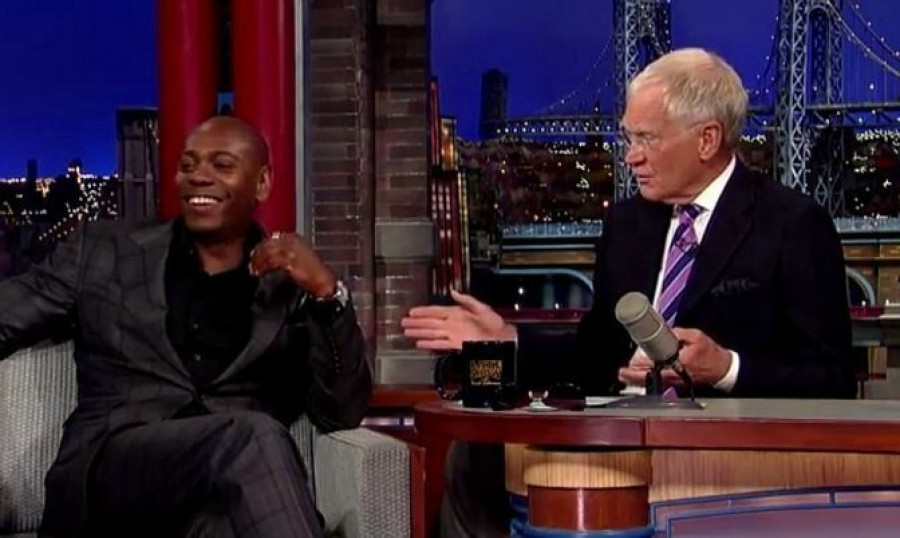

One of the things I speak to all of my clients about is critical illness insurance because the majority of the people you know who have been affected by cancer, heart attack or stroke didn't see it coming. However unlike David Letterman's show, situations such as these are by no means funny.

Nobody gets up in the morning and says "today I will have a heart attack, suffer a stroke or be diagnosed with cancer", and some of the seemingly healthy, active and fit people we know who have been affected by any of these life threatening illnesses literally "Didn't see that coming".

According to the Canadian Cancer Society 40% of women and 45% percent of men in Canada will be affected by cancer in their lifetime, and according to the Heart & Stroke Foundation 1 in 4 Canadians will suffer a heart attack, and 50% of the people who have heart attacks are under age 65. Thankfully survival rates have significantly improved, and as such affected persons tend to worry less about saving their lives and focus more on preserving their quality of life, and critical illness insurance is designed to help you do just that - preserve your quality of life.

Why do I recommend critical illness insurance as one of the fundamental building blocks of any solid financial plan?

Because in addition to the devastation of being diagnosed with cancer or any other life threatening illness, there are some other issues you probably didn't see coming:

• Depletion of retirement savings (assuming you have any) to pay for treatments not covered by provincial health plans (OHIP doesn't cover everything)

• Becoming financially destitute (especially if you are self employed and can't work to generate income)

• Having to choose between keeping your home or paying for treatment, particularly treatment outside of Canada.

• Reduction of household income as your partner will definitely take time off work to be by your side through this difficult and heart wrenching process

Critical illness insurance is all about protecting your lifestyle because it pays a tax free lump sump 30 days after diagnosis, so you don't have to worry about money in the event you are diagnosed with cancer, stroke or heart disease. It is also one of the few insurance products that offers a refund of premium option if you remain healthy and never have a claim.

The only time I would want to hear "Didn't see that coming" is from a friend or relative of yours in the event I am at your home delivering a tax free lump sum cheque because you were diagnosed with cancer or another life threatening illness, and have absolutely nothing but getting better on your mind.

By

By