having enough money in retirement, loss or damage to their home or vehicle without giving a second thought to what would happen if they couldn’t work and their paycheque stopped coming in.

If you have acquired assets, chances are your income is the reason you enjoy your current lifestyle, but what if you became disabled today? Would your income be significantly reduced or worse, disappear altogether? How would you pay your for things like your mortgage, children’s education, trips to a warm place in the winter, or the basic necessities of everyday life? Would CPP provide enough to replace your income?

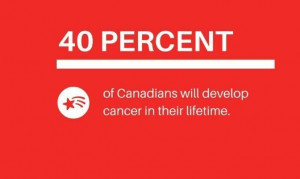

You may be reading this and saying well “Nothing will happen to me”, however your fellow Canadians who have lost their homes and have had their lives turned upside down as a result of an unexpected injury or sickness probably said the same thing. You may be thinking well “I don’t earn that much anyway”, however if you are age 35 and earning $40,000 per year, your income earning potential over the next 35 years is actually $1,400,000 and protecting your ability to earn that income should be your main concern.

Disability insurance provides you with a monthly cheque in the event you become disabled or seriously ill and can’t work, and is designed to replace a portion of your income. There are policies that will ensure that as long as you are disabled and can’t perform the duties or your own or regular occupation (This is very important), you will receive a monthly cheque up to age 65, and if you don’t become disabled you can get part or all of your money back at age 65 (If you think of all the you money spent over the years on car insurance and you never claim and never receive a dime in refunds, you will see that disability insurance makes even more sense)

If you have no long term disability coverage at work or if you are self-employed; refusing to seriously consider adding disability insurance to your financial fitness plan, is like heading outside in minus 20 degree temperatures wearing shorts and a golf shirt.

By

By