1. What’s In A Name?

Even though it’s called a savings account, you can put more than cash in there. Often times, when you think of savings in a bank, you think safe and low-interest rates. However, whatever you can hold in a registered retirement savings plan (RRSP), you can hold in a TFSA. Products such as bonds, stocks, mutual funds, exchange-traded funds, options, etc. It is better to use a TFSA for investments than cash savings as generally speaking it doesn’t pay much – around 2%. What you need to do is look at your TFSA as a savings shelter like an RRSP, but with tax-free benefits.

2. TFSAs Can Be Tricky

You must be careful with TFSAs and how you make withdrawals and deposits. This is not your typical savings account. If your total deposit is more than the annual limit, then you have over-contributed. You must remember that every time you put in money it counts as a contribution regardless of the total amount in the account. For example, if you deposit $1000 and then take it out and then put in $1000 in the same year, you are considered to have contributed $2000. Your contribution amount starts again in the new year. One other thing to watch is if you decide to move your TFSA from one financial institution to another by withdrawing the funds and re-depositing it. This could also cause an over-contribution. The way to avoid this is by making it a transfer between institutions instead.

3. Know Your Limit

It’s also important to know your contribution room so that you don’t run into problems with going over the limit – which results in a penalty of 1% of the excess contribution every month until it’s withdrawn. Just like your RRSP limit, the Canadian Revenue Agency gives you your annual contribution limit on your income tax notice of assessment. It will show you each year’s contribution limit, which is the total of three amounts:

* $6000 (as of 2019)

* Amounts withdrawn from the previous year

* All unused contribution room from previous years

Keep in mind, that you can’t lose your TFSA contribution room. And if you have never opened a TFSA, start one today and you can contribute up to $63,500 since you haven’t contributed anything since the start of TFSAs in 2009. Each year’s various contribution limits (it changed from year to year by the government) adds up to $63,500.

4. Carry It Forward

Unused contributions from each year are carried forward and withdrawals typically result in new contribution room. For example, if you take out $20,000 from your TFSA this year for a vehicle, you will have $26,000 in contribution room next year (the $20,000 you took out plus another $6,000 for 2020).

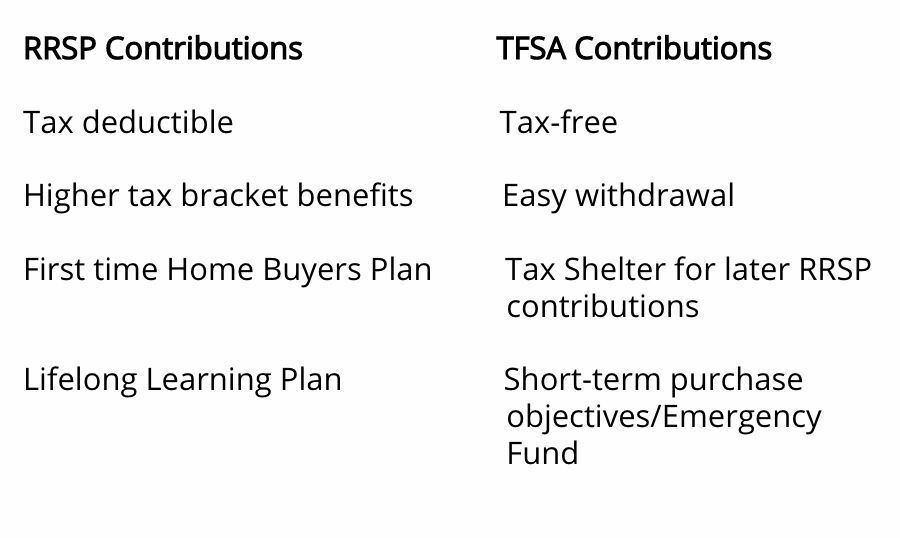

5. TFSA versus RRSP

An RRSP is a good option for long-term goals like retirement, while TFSAs are better for short-term goals like a house down payment or car. Here are the benefits of each one.

One way to make your money work for you is to maximize your RRSP contributions to get a large tax refund, and then take that money and put it into your TFSA. You save for retirement, get the tax benefit and have savings that you can withdraw at any point tax-free.

There are a lot of smart ways to make the TFSA benefit you financially. Whether it’s through various investments, savings and RRSPs, your financial advisor can help you make the decisions that increase your wealth for the short-term and your future.

Ian Webster's nearly two decades of recognized experience at several well-known financial organizations has given him the inside track on the upsell of products such as mortgages and mutual funds and allowed him to help clients with everything from lowering their taxes to developing profitable investment portfolios. His expertise has been featured in The Globe and Mail, Toronto Star, Toronto Sun, and Time. He has also been a featured financial speaker at many high-profile networking functions. Find Ian online at www.financialfighter.com and on Twitter, Facebook, Linkedin, and Instagram.