Many of us invest in mutual funds because it seems like the simplest way to get into the stock market game. You basically leave it up to your financial advisor to pick what makes sense to them and let it sit in your RRSP, losing and gaining money over the years. The simplest way to explain how it works is this: a mutual fund pools money from many investors (like you) to purchase securities. This allows you to have your hand in a number of pots. Some of the benefits include:

* Diversification

* Liquidity

* Professional Management

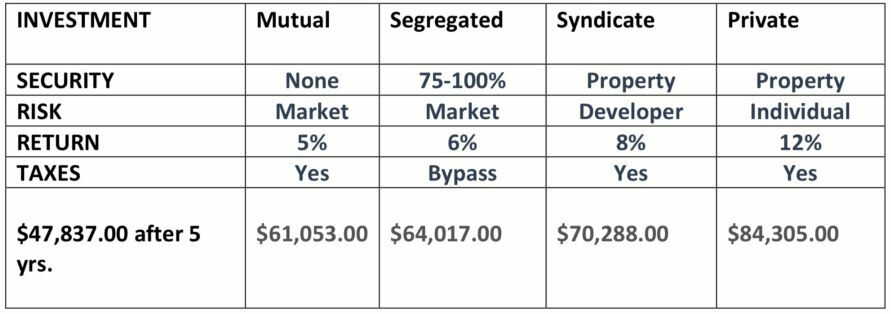

But with every up, there is a down. It is really like being in Vegas, your returns are unknown until you’re ready to cash out. And even though I am giving a simplified breakdown of what mutual funds are, they are not that easy to understand. What many people do know is that it can be stressful when you are continually losing thousands of dollars over a period of time. If you were to look at a five-year span for the average investor, the rate of return is 4 to 6%.

And that’s roughly the same if you invest in a segregated fund. Call this a combo type investment that puts together the growth potential of a mutual fund with the security of a life insurance policy. There are certain guarantees you get, like a 100% reimbursement of capital upon death. Other benefits:

* Maturity Guarantees – 75%

* Bypass Probate (Taxes)

* Creditor Protection

Now, this all sounds great, but again it’s back to Vegas – the returns are unknown, it depends on when you cash out.

There are two other options that can give you a much better return, but it will depend on how comfortable you feel with being a lender. There is a growing movement of investors who want more control of their money and are venturing into private lending or syndicate mortgages. With private lending, you take on the role of the bank and provide the mortgage for the homeowner. By doing so this allows:

* Short payback period (1-2 years)

* Investor capital secured against real property

* Higher interest rates

* Short approval process done by you – the lender

The downside to this is that you have to be comfortable with collapsing the mortgage for non-payment and selling the home to recoup. If you are easily swayed by a person’s circumstances behind not paying, this is not for you. However, it can be quite lucrative with the potential average investor rate of return being 9 to 15% over a five-year period. A syndicate mortgage can give you about the same rate, but has a little less individual risk. It’s when two or more investors pool their money together in one mortgage. Each person’s investment is registered and recorded according to the percentage of the overall mortgage they have contributed or invested. Just like private lending, your investor capital is secured with real property. Here are some of the other bonuses:

* AACI Designated Appraisal – this is the “Gold Standard” of appraisals

* Fixed Secured Return

* ILA – Independent Legal Advice given at no cost to the investor

There are no bi-annual statements with this type of investing and it’s not liquid – once you’re in, you’re locked in for the mortgage period.

In the end, you need to invest at your own comfort level, but you also want to make sure that your money is working for you to reap the best returns possible.

Now you have the information to make the best decision for you and your money.

Ian Webster's nearly two decades of recognized experience at several well-known financial organizations has given him the inside track on the upsell of products such as mortgages and mutual funds and allowed him to help clients with everything from lowering their taxes to developing profitable investment portfolios. His expertise has been featured in The Globe and Mail, Toronto Star, Toronto Sun, and Time. He has also been a featured financial speaker at many high-profile networking functions.

Find Ian online at www.financialfighter.com and on Twitter, Facebook, LinkedIn, and Instagram.