The question you should be asking yourself when you make your RRSP contribution this year is not how much money will you be getting back when you get your taxes done (although getting money back from the government is great); but rather how much monthly income will you have when you retire.

If you participate in your employer's pension plan (including a government pension) you may have a good idea of what your monthly income (for the rest of your life) might look like when you retire.

Whether or not your retirement savings plan includes pension funds RRSPs, CPP and OAS, there are two questions you should be asking yourself with respect to what is likely to happen whenever you decide to retire:

1. What will my income be on a monthly basis when I retire?

2. Will that income last me for the rest of my life or will I outlive my money?

With respect to RRSP contributions, many Canadians simply go to their bank and make a deposit, or they do it by monthly contributions, or they speak to their financial advisor who advises them to place their money in some form of investment vehicle, whether it be mutual funds, segregated funds etc.

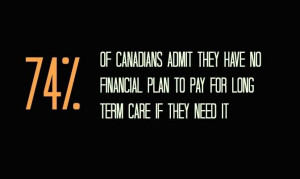

Typically your bank, financial advisor or investment broker can't tell you today how much income your RRSP will provide in the future, and as such, you really have no idea how much income you will have when you retire, and no idea if that income will be sufficient to support you for the rest of your life.

There is a product that can tell you TODAY and also GUARANTEE what your minimum monthly income will be from the day you retire until you pass away .

It is called Guaranteed Minimum Withdrawal Benefit (GMWB) and it is only offered by a few insurance companies in Canada (not available from banks) , and can be held in RRSPs, TFSAs, and Non-registered investments.

Before you make your RRSP contribution, call me to book your free consultation; tell me at what age you would like to retire and how much monthly income you want to earn; and I will guide you on the path that will help you reach your goal.

Your financial future is too important to leave to chance. Start planning for it today!

By

By