Tip #1: Engage a financial strategist

Real estate investing can take many forms, from renting out an unused room in your home on the weekends to buying a massive commercial property with multiple tenants. Deciding where to start and what to tackle with your time, money, and energy can be a challenge.

To meet this head-on, consider partnering with an unbiased financial strategist. This person or firm will be equipped to look over your financials and then help you connect them to your goals. They will also have tools and strategies that help optimize your money and wealth building in the area of real estate investing.

Tip #2: Crunch the numbers

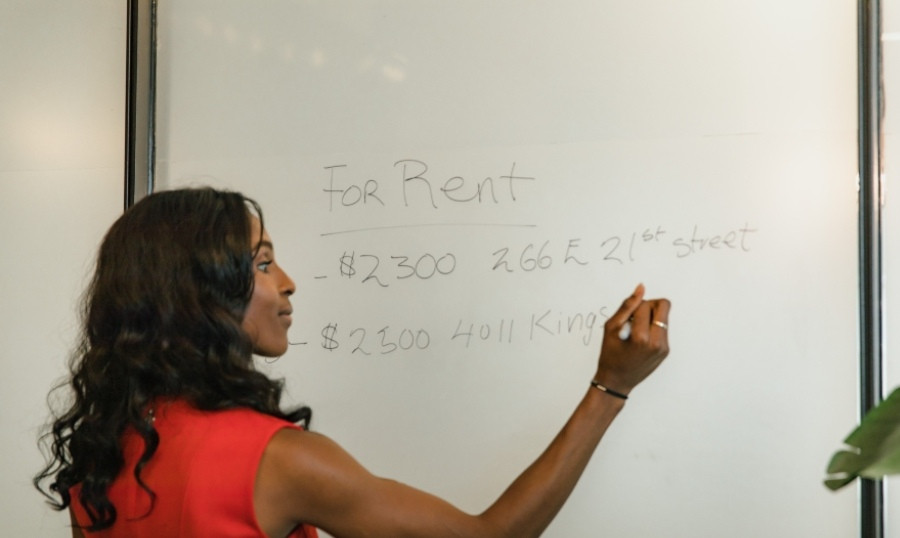

Successful real estate investing often comes down to numbers. It is easy to view properties and fall in love with an eclectic rental home near Queen’s Park or a cool commercial storefront in Cabbagetown, but which should you buy? Or should you pass on both?

Many times, the numbers will help you make an informed decision. By understanding and tracking things like market rents and trends, cost of repairs and remodels, taxes and insurance, and miscellaneous other expenditures required for each prospective property, you can get a 360-degree view. This will help you know the true cost of ownership and evaluate the financial potential of each property.

Tip #3: Don’t get emotional

Remember that expression, “It’s not personal, it’s just business”? Real estate investors would do well to keep this as a mantra. When shopping for a Toronto real estate investment property, negotiating the terms of a sale, and even deciding what to remodel, it is essential to remove the emotions from the equation.

Emotional buying tends to ignore facts, figures, and data and choose what feels good in the moment. If you are investing in real estate to make money and grow your net worth, then you have to be able to make decisions that will accomplish this goal, even if they don’t align with all of your personal preferences and emotions.

Tip #4: Work out financing early

Toronto is an extremely hot city for real estate. Because of this, it isn’t uncommon for real estate investors to end up in bidding wars or, at the very least, need to move quickly when they find a great property. Many property sellers won’t wait around for you to get your financing figured out and will often reject offers from buyers who aren’t yet pre-approved.

With this in mind, do the legwork early with your lender or financier so that when you begin shopping for real estate investment property, you know what you can afford and are confident that you can secure the loan needed to buy it. This will ensure that you don’t waste your own time or that of a seller either.

Final Thoughts

Getting started as a real estate investor in Toronto isn’t out of reach if you are willing to be patient and take the necessary steps to be successful. However, it is a long game strategy, so plan accordingly, learn all you can, and surround yourself with people who can help advise and direct you.

At CleveDoesMore, the best part of our job is helping people make informed choices to minimize their risk while building equity and wealth for their future.

By

By